North vista Capital

We See the Big Picture

North Vista Capital is an investment firm targeting value-add multifamily

investments in Southern California and South Florida.

North Vista Capital is an investment firm targeting value-add multifamily investments in Southern California and South Florida.

ABOUT

North Vista Capital is a vertically integrated real estate investment company focused on the acquisition and proactive management of apartments in Southern California and South Florida. The Principals have extensive experience in real estate investments. Gary Steinhardt has been sourcing quality real estate investments for institutional investors for over twenty years. Michelle Steinhardt has been practicing law for more than sixteen years, including as a Partner at the 24th largest law firm in the United States.

We create value for ourselves and our investors by acquiring and improving highly desirable properties in non-commodity locations. Our objective is to increase cash flows through targeted capital investments that enhance property appeal and improve operations, thereby increasing rents and tenant retention while reducing expenses.

Our institutional backgrounds shape our hands-on, design-driven, entrepreneurial approach, which allows North Vista Capital to reposition undermanaged and/or undercapitalized properties. We create and implement appropriate renovation programs to enhance tenant appeal/retention, marketability, and property value. As we grow net operating income, we periodically refinance or sell properties as capital markets permit to provide refinancing (tax-free) or sales (capital gains) proceeds to our investors.

MISSION STATEMENT

North Vista Capital provides investors access to multifamily investments designed to produce stable cash flows and enhance value through the acquisition, management, and hands-on repositioning of multifamily properties to benefit our investors, the community, and our residents.

Investment strategy

North Vista Capital, through private partnerships, acquires thoughtfully selected properties in Southern California and South Florida. We pursue long-term and short-term investment strategies. One of our primary strategies is a “value-add and hold” strategy. North Vista Capital creates value through hands-on repositioning with the goal of returning capital (tax-free) through periodic refinancing and providing stable cash flow for the duration of the hold. We believe the key to this strategy is the enhancement and long-term ownership of quality properties.

North Vista Capital targets infill markets with higher barriers to new supply in established and transforming neighborhoods to increase the potential for material appreciation. We pursue properties larger than those sought by less sophisticated investors but smaller than those sought by larger syndicators and institutional investors. We believe that more arbitrage and value opportunities exist in this segment of the market.

North Vista Capital is actively seeking acquisition opportunities in select geographic markets with the appropriate mix of current income and long-term appreciation potential.

Investment Criteria

Target Markets

The Principals of North Vista Capital have extensive experience investing in Southern California and South Florida. North Vista Capital seeks to purchase and improve smaller multifamily properties in established and transforming markets. We target markets with high barriers to entry, population growth, job growth, and desirable lifestyle characteristics. We consistently review and evaluate demographic trends to identify markets with these demand drivers.

Southern California – A mature market with high barriers to supply. The appeal of the Southern California lifestyle will continue to attract residents and businesses. In an inflationary environment, revenues should increase at a faster rate than expenses, as California’s Proposition 13 limits the growth of one of the largest expenses (taxes).

South Florida – A growth market with some areas maturing and barriers to entry increasing. We see strong employment and demographic trends driving top-line growth in these markets.

5-50 Units

Value-Add

$1.5 – $10 Million

Non-Commodity Locations

Opportunities We Pursue

- Assets requiring exterior and/or interior enhancements

- Assets with the potential to add density or re-entitle for higher and better uses

- Value-add, core-plus, and opportunistically core

- General preference for larger units

Non-Commodity Location Features

- Proximity to employment centers, transit, recreation, shopping, and/or entertainment

- High walk score

- Views

- Well rated school systems, or

- Other desirable features

Services

North Vista Capital seeks properties that can be enhanced through physical and operational repositioning. We conduct thorough due diligence during the acquisition process and develop an asset-specific repositioning strategy that serves as a road map to unlock value. This strategy often includes interior and exterior improvements, the addition of units such as Accessory Dwelling Units in markets such as Los Angeles, and/or entitlement for higher and better uses.

Construction Management

North Vista Capital designs and implements asset-specific strategic capital plans for each investment. The capital plan will address any deferred maintenance and property improvements intended to maximize rents while still providing value to our tenants and reduce operating expenses. Many relatively inexpensive but thoughtful improvements can provide a significant return through the combination of increased curb and unit appeal and enhanced tenant retention. We actively manage capital expenditures to ensure completion on time and on budget.

Examples of low-cost, high impact improvements include:

- Exterior improvements such as fresh paint, lighting, awnings, trellises, and landscaping

- Inexpensive interior touches include USB outlets in all appropriate locations, outlets with integrated nightlights in bathrooms, dimmer switches, ceiling fans, paint, built-ins as appropriate to maximize space efficiency, and appropriate integration of technology while minimizing the potential for tech obsolescence

- Installation of energy-efficient and attractive lighting and appliances (as needed), including climate control

Financing

North Vista Capital employs a disciplined, conservative, and thoughtful use of leverage to enhance returns without significantly increasing the risk. We will source appropriate acquisition and subsequent financing for each asset to align our financing strategy with the asset-specific plan and investor goals.

Dispositions

North Vista Capital continually evaluates each asset for optimal disposition timing.

Asset Management

The Principals of North Vista Capital are actively involved in each asset’s strategic and daily management. Asset management services include:

- Extensive in-house digital marketing capabilities. Each property will have its own website and a presence on multiple social medial platforms.

- Tenants will have access to an online payment and service request portal.

- Principals’ personal focus on controllable operating expenses.

Principals take a hands-on (sometimes with their own hands) approach to executing appropriate capital investments to ensure completion on time and on budget.

Consulting Services

Principals of North Vista Capital also provide consulting services in their respective areas of expertise.

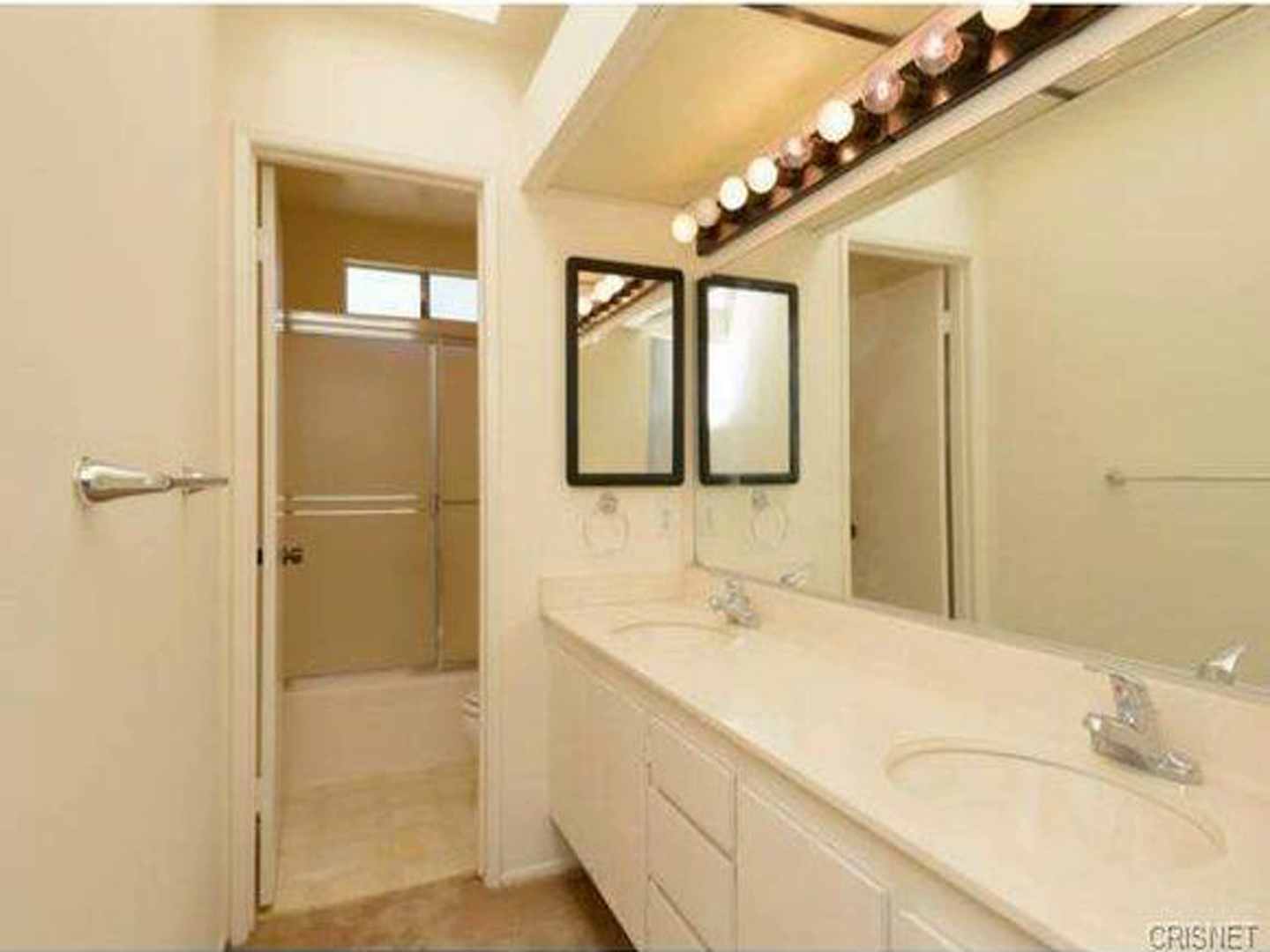

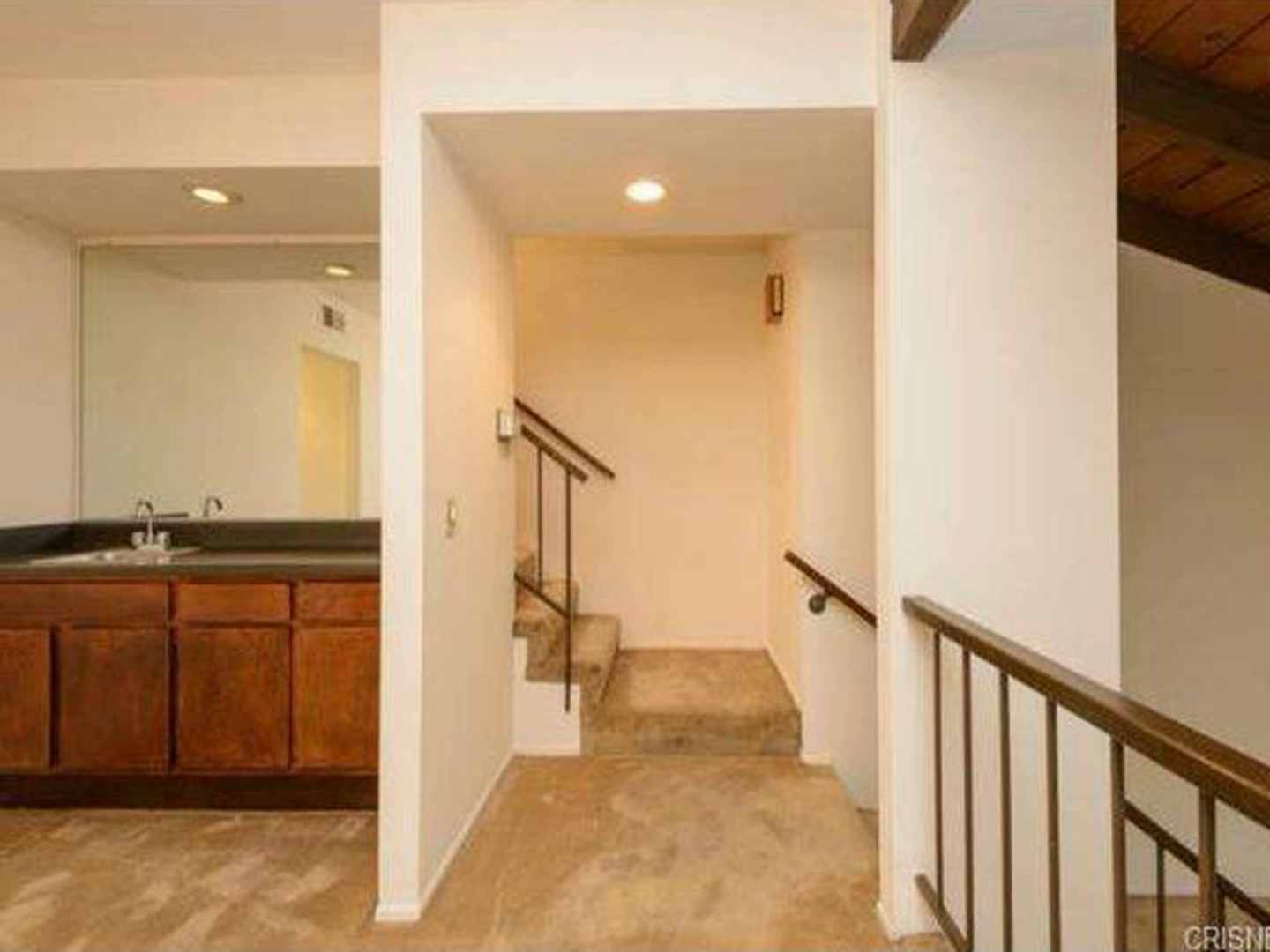

Case Studies

Before and after renovations

NORTH VISTA CAPITAL PRINCIPALS

Gary Steinhardt

Gary’s deep institutional real estate investment experience includes nearly seventeen years at American Realty Advisors, one of the largest privately-held real estate investment management firms in the U.S, and approximately five years at Wells Fargo and Eastdil. Gary has been responsible for sourcing and closing core and high-yield investments, including direct equity, joint venture, secured debt, and note purchases totaling approximately $2 billion net (over $13 billion gross). Gary has extensive real estate investment experience throughout the country, including Southern California and Florida. While at Eastdil, Gary worked on the marketing and sale of approximately $870 million of institutional quality real estate.

Gary brings a hands-on solution-oriented approach to value-add investing. His design sense and ability to execute cost-effective and thoughtful improvements have produced strong results from the renovation of several value-added single and multifamily investments.

Gary has over twenty-two years of real estate experience. He earned a B.A. degree from the University of Massachusetts, Amherst, an M.B.A. from the University of Southern California, Marshall School of Business, and completed Wells Fargo’s six-month advanced credit-training program. Before earning his M.B.A., Gary spent six years in the art book publishing industry, which contributed to his passion for construction and design.

As a Partner at Gordon Rees Scully Mansukhani, LLP, the 24th largest law firm in the United States, Michelle represented a diverse roster of companies across multiple industries. Michelle is an experienced attorney with over sixteen years of proven results representing small businesses to Fortune 500 companies. She has drafted and negotiated countless contracts throughout her legal career and oversaw hundreds of lawsuits, including multiple multimillion-dollar pension class actions.

She also holds a real estate salesperson license (DRE# 02151219) and earned a certificate in Commerical Real Estate from eCornell.

Michelle is a diligent problem solver with the ability to manage complex matters. Her focus on strategic planning has been a key to her success. While practicing law, she received the distinguished honor of being listed as one of Southern California Rising Stars in Employment Law.

After leaving her position as a Partner, Michelle oversaw all aspects of a multimillion-dollar business disposition. Her leadership through contract negotiations, due diligence, and closing resulted in the successful sale of the company.

Michelle is also a digital content creator and the founder of The Trav Nav, a luxury travel blog.

Michelle Steinhardt

Michelle Steinhardt

As a Partner at Gordon Rees Scully Mansukhani, LLP, the 24th largest law firm in the United States, Michelle represented a diverse roster of companies across multiple industries. Michelle is an experienced attorney with over sixteen years of proven results representing small businesses to Fortune 500 companies. She has drafted and negotiated countless contracts throughout her legal career and oversaw hundreds of lawsuits, including multiple multimillion-dollar pension class actions.

Michelle is a diligent problem solver with the ability to manage complex matters. Her focus on strategic planning has been a key to her success. While practicing law, she received the distinguished honor of being listed as one of Southern California Rising Stars in Employment Law.

After leaving her position as a Partner, Michelle oversaw all aspects of a multimillion-dollar business disposition. Her leadership through contract negotiations, due diligence, and closing resulted in the successful sale of the company.

Michelle is also a digital content creator and the founder of The Trav Nav, a luxury travel blog.

PHILANTHROPY

Michelle and Gary believe it is important to give back to their community. They have been long-time supporters of City of Hope. Michelle was on City of Hope’s Building Hope Executive Board from 2015 through 2019, and she co-chaired the Los Angeles Real Estate Walk for Hope Team. During her time on the Building Hope Executive Board, Gary and Michelle helped raise over $50,000 for women’s cancers. In 2016, Michelle received the City of Hope, Building Hope Volunteer of the Year award.

PHILANTHROPY

Michelle and Gary believe it is important to give back to their community. They have been long-time supporters of City of Hope. Michelle was on City of Hope’s Building Hope Executive Board from 2015 through 2019, and she co-chaired the Los Angeles Real Estate Walk for Hope Team. During her time on the Building Hope Executive Board, Gary and Michelle helped raise over $50,000 for women’s cancers. In 2016, Michelle received the City of Hope, Building Hope Volunteer of the Year award.

Sustainability

North Vista Capital is committed to environmentally friendly practices that benefit the community and enhance the tenant experience. We develop a sustainability plan for each investment as part of our value-add strategy to reduce ownership’s operating expenses and/or tenants’ occupancy costs.

Because one of our primary strategies is to hold for the long-term, we use durable materials to increase sustainability and reduce future capital and operating costs.

Energy-efficiency

Water Conservation

Waste Reduction

Energy-efficiency

Water Conservation

Waste Reduction

Customized strategies are available to investors. To discuss your investment goals, contact either of the Principals below.

Customized strategies are available to investors. To discuss your investment goals, contact either of the Principals below.

Follow Us On Social Media